Understanding Cryptocurrency Forks: Hard Forks vs. Soft Forks

Cryptocurrency forks have become a defining feature of the ever-evolving digital currency landscape, sparking discussions, controversies, and opportunities for innovation. Whether you’re a seasoned investor or a curious enthusiast, understanding the intricacies of cryptocurrency forks is crucial in navigating this dynamic ecosystem.

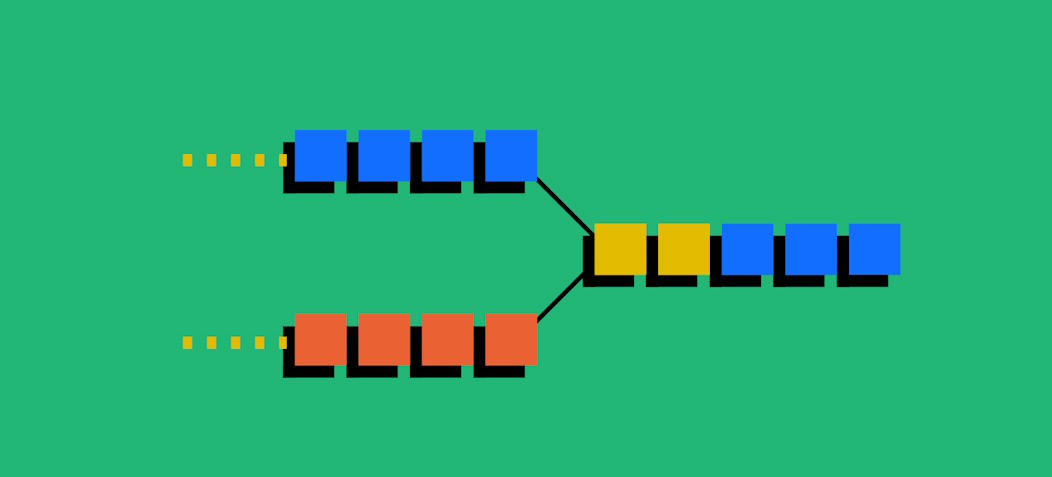

Key Differences between Hard Forks and Soft Forks

When it comes to cryptocurrency forks, understanding the key differences between hard forks and soft forks is essential. These two types of forks not only differ in their technical aspects but also have distinct implications for governance, community cohesion, and ecosystem development. Additionally, they vary in terms of technical considerations and backward compatibility. Let’s explore these differences in more detail:

Fundamental Distinctions in Governance and Consensus:

Hard forks and soft forks diverge in their approach to governance and consensus. Hard forks are characterized by a more radical shift in the underlying protocol, resulting in a permanent divergence from the original blockchain. This requires a consensus among the community to adopt the new protocol, often leading to the creation of a separate cryptocurrency. In contrast, soft forks introduce backward-compatible changes to the existing protocol, allowing the network to maintain a unified blockchain and consensus.

Implications for Community Cohesion and Ecosystem Development:

Hard forks and soft forks also have varying implications for community cohesion and ecosystem development. Hard forks can lead to divisions within the community, as different factions may have conflicting views on the new protocol. This can result in fragmented communities and competing cryptocurrencies. On the other hand, soft forks generally promote a more cohesive ecosystem, as they maintain compatibility with the existing protocol, allowing for smoother transitions and minimal disruption.

Forks and Investor Considerations

Factors to Consider when Evaluating Potential Investment Opportunities Related to Forks:

When assessing investment opportunities related to forks, investors should consider several key factors. These include the development team behind the fork, their track record, and the technological improvements or innovations introduced. Evaluating the community support, adoption rate, and market demand for the new forked cryptocurrency is also crucial. Additionally, analyzing the potential impact on scalability, security, and functionality can provide insights into the long-term viability and value proposition of the fork.

The Future of Cryptocurrency Forks

As the world of cryptocurrencies continues to evolve, the future of cryptocurrency forks holds both exciting possibilities and intriguing challenges. Exploring the trends and developments in the frequency and nature of forks, as well as emerging technologies that may mitigate their need, provides insights into the maturation and adoption of cryptocurrencies as a whole.

Trends and Developments in the Frequency and Nature of Forks:

In recent years, we have witnessed a significant increase in the frequency of forks. This trend can be attributed to several factors, including the growing number of cryptocurrencies and the decentralized nature of blockchain technology. Furthermore, forks have become a mechanism for addressing scalability issues, improving security, and introducing new functionalities. We may expect to see more specialized forks catering to specific use cases or communities, creating diverse ecosystems and promoting innovation.

Emerging Technologies and Protocols Mitigating the Need for Forks:

The emergence of new technologies and protocols holds the potential to mitigate the need for forks. Layer 2 solutions, such as the Lightning Network, enable off-chain transactions, improving scalability and reducing congestion on the main blockchain. Interoperability protocols, such as Polkadot and Cosmos, facilitate communication between different blockchains, enabling collaboration and synergy. These advancements may alleviate the necessity for hard forks by offering scalable and flexible solutions within the existing blockchain ecosystem.

- Posted In:

- Latest Crypto News